OCBC Business app is only available to business customers who have access to OCBC Velocity in Singapore.

If your company has yet to sign up for OCBC Velocity, please apply for OCBC Velocity here.

The OCBC Business Debit Card now comes in a new design!

Earn unlimited cashback on your everyday business spend!

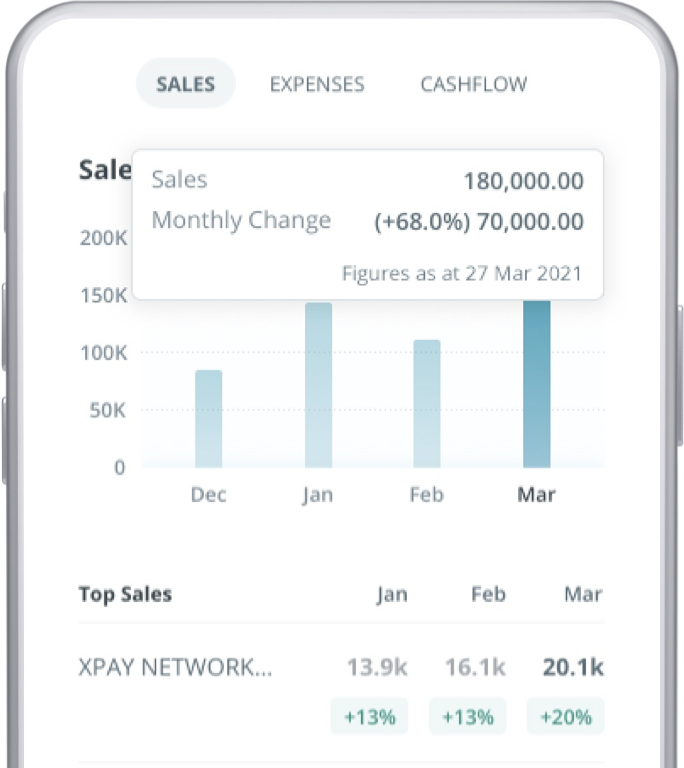

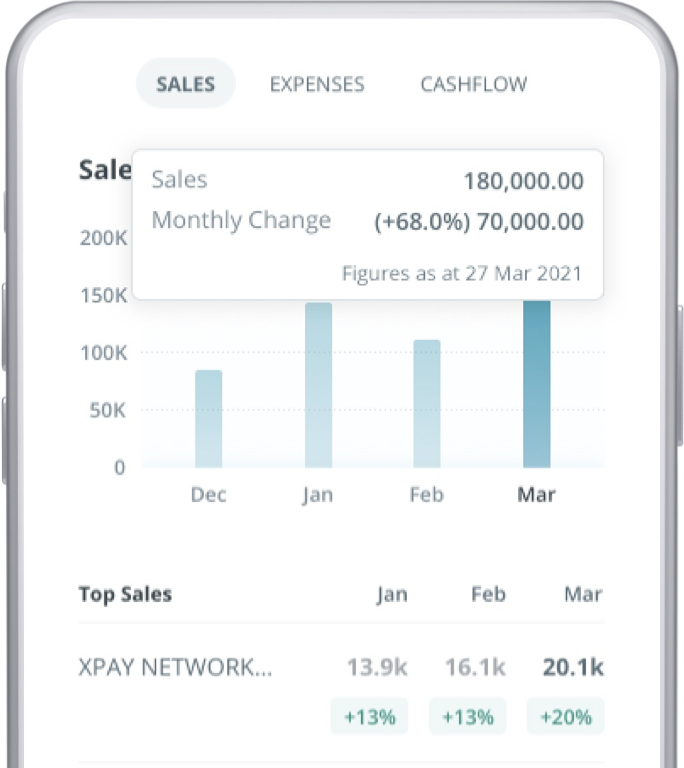

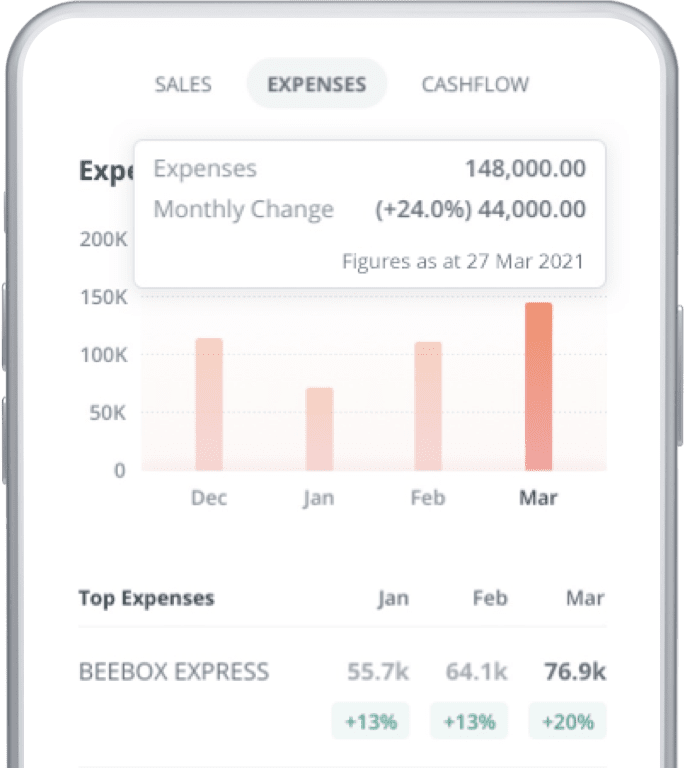

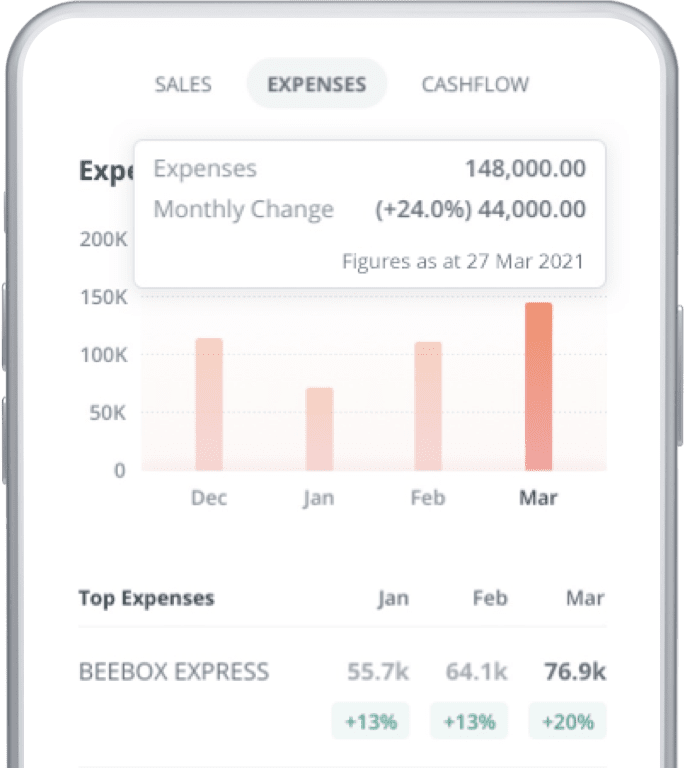

Get direct valuable insights into your sales, expenses and cash flow trends

Access frequently-used features with just one quick tap

Manage day to day business banking easily with an intuitive, user-friendly interface

Get real-time alerts for added security - helping you to watch out for your business

You know a great deal about your business but sometimes, a little help goes a long way. Never run your business without the multi-useful OCBC Business app – gain more convenience with the suite of tools to better manage your business from anywhere.

Save money and boost cash flow while protecting your business against foreign currency fluctuations.

Save money and boost cash flow while protecting your business against foreign currency fluctuations.

Gain greater peace of mind with full visibility of your business transactions and price alerts in real-time.

Gain greater peace of mind with full visibility of your business transactions and price alerts in real-time.

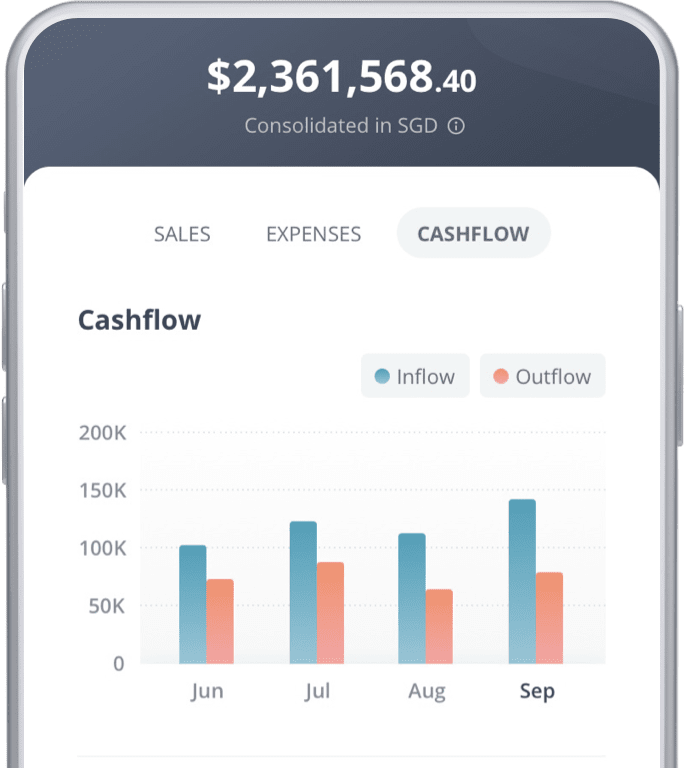

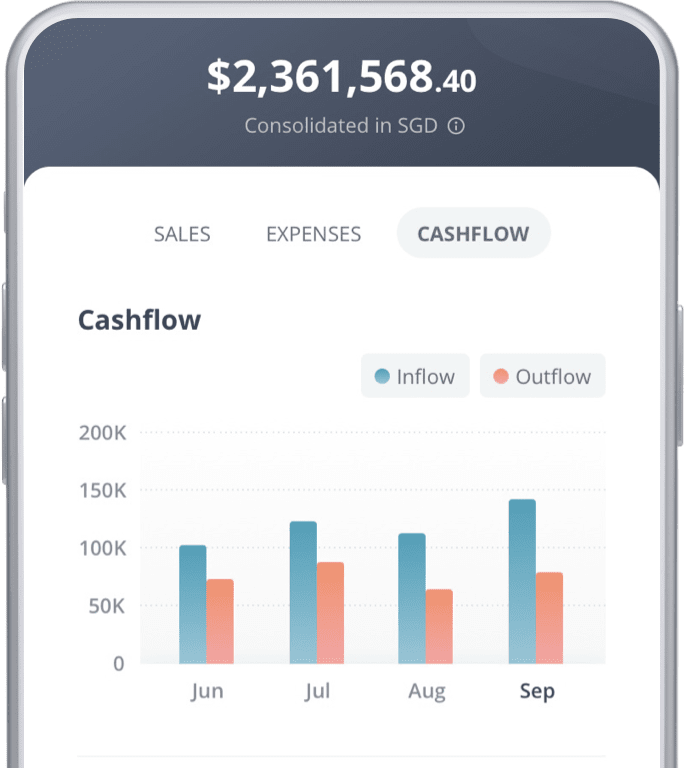

Easily access all your business expenses, sales and cashflow data in one place and get greater control of finances.

Easily access all your business expenses, sales and cashflow data in one place and get greater control of finances.

Analyse your customers’ current and historical* buying behaviour and use it to effectively plan customer relationship management and marketing efforts and build sales momentum.

*Up to 4 months of history.

Use it to help analyse your business spending. See where to save money or where to spend it to make more money and gain more control over cash flow.

Useful for analysing your money in and money out to help you to manage it better and plan smarter. Identify patters and get insights that can help you make strategic decisions to grow bigger faster.

OCBC for travel & hospitality

Working with worldwide partners and customers? Learn how Adrian Chia, Co-founder of Tiny Assets – an eco-tourism company with over 350 properties globally – uses the OCBC Business app’s FX alerts to book foreign currency rates that boosts their bottom line.

OCBC for healthcare

Free up time to focus on better quality care and quality growth opportunities? Dr. Zhang Hao Tian, Medical Director of One Medical Group shares how the OCBC Business app helps him to monitor the financial health of his practice and watch out for useful insights that led him to starting up a medical supplies company.

OCBC for F&B

Cook up new ways to increase sales? Nigel Kok, General Manager of Rich Food Catering serves up how he uses the OCBC Business app to spot sales spikes and capitalise on trends for business growth, while also giving him control even when he’s on the move.

OCBC for health & wellness

Looking to streamline approvals? Caleb Leow, Founder of Blood – a feminine care products company with a mission to empower women around the world – uses the OCBC Business app to approve transactions on his mobile, on-the-go.

OCBC for F&B

Faced with fluctuating business costs? Find out how Thomas Ho, 3rd generation owner of Chew Kee Eating House, makes use of cashflow trends on his OCBC Business app to better track and manage monthly flows of money in and money for a clearer overview of his company’s financial position.

OCBC for eCommerce

Always on the move? See how Serene Sim, Founder of E-Essential SG, an online marketplace, makes use of her sales and expenses trend data on her OCBC Business app to run her business better.

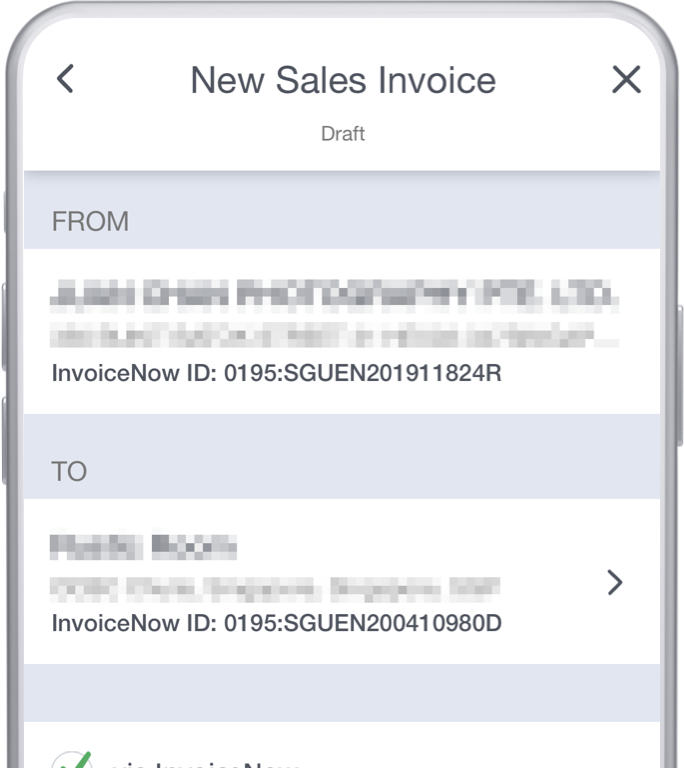

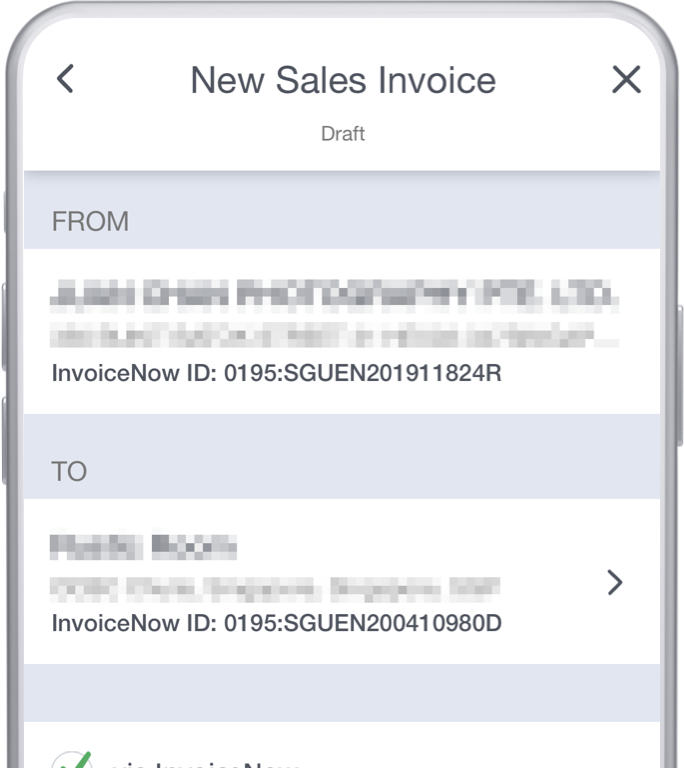

Use it to easily create and send e-invoices, even when you are on the go. This helps to speed up invoice processing, automate manual work and reduce data entry errors.

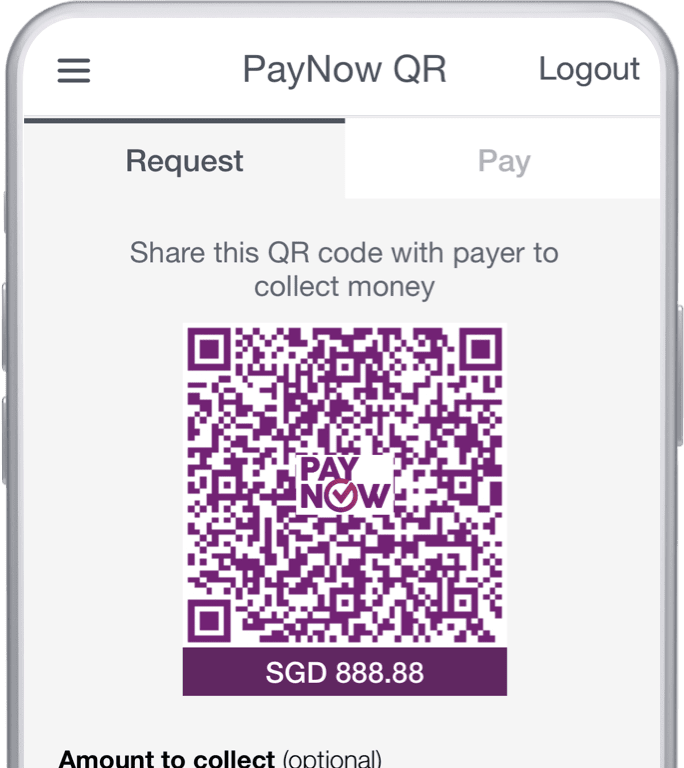

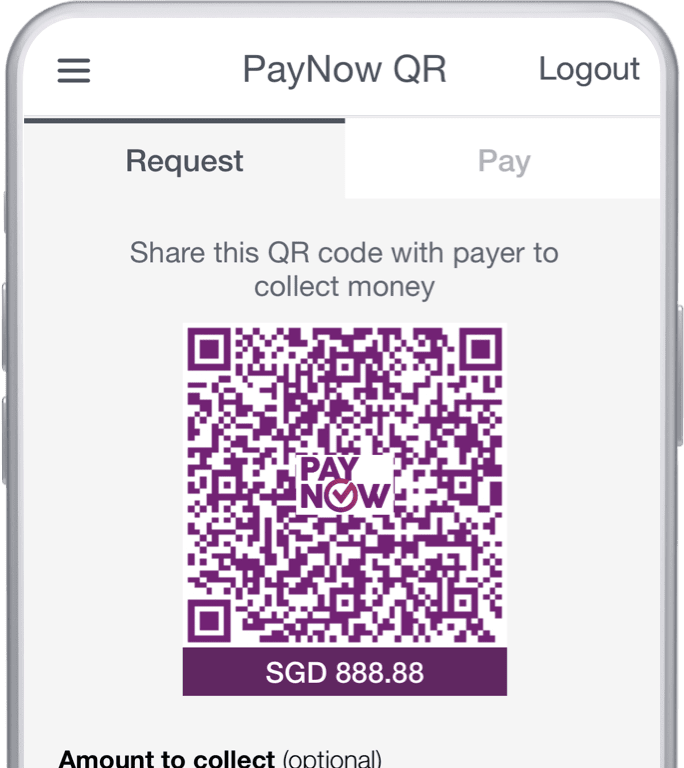

Enjoy instant collection and direct account crediting. Simply let your in-store customers conveniently scan and pay via QR codes or generate QR code requests for your invoices.

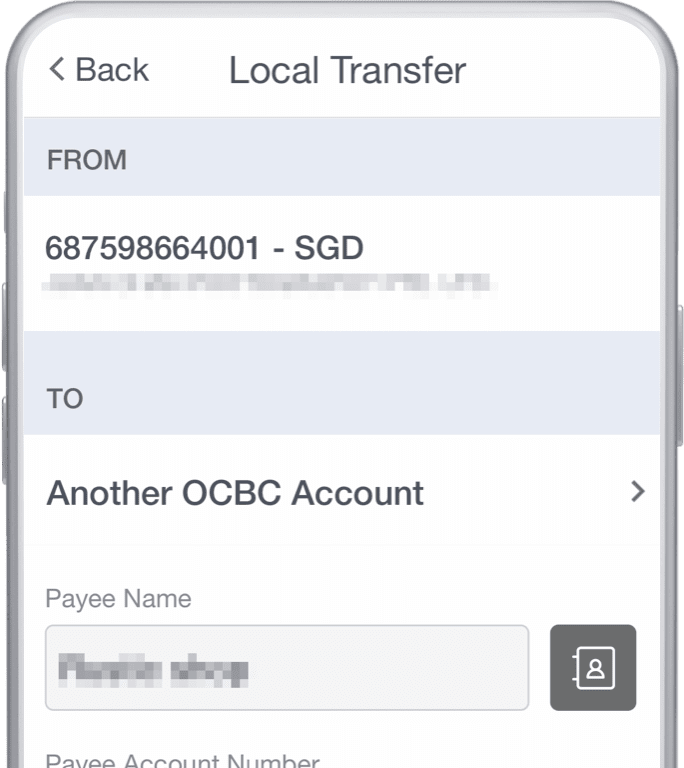

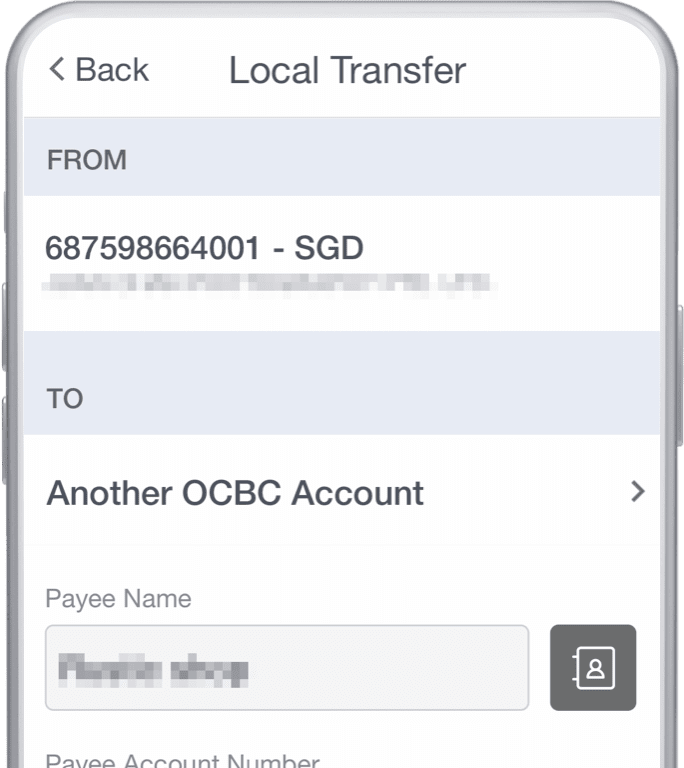

Make local and international transfers swiftly, simply, and securely with services that suit your multiple business needs.

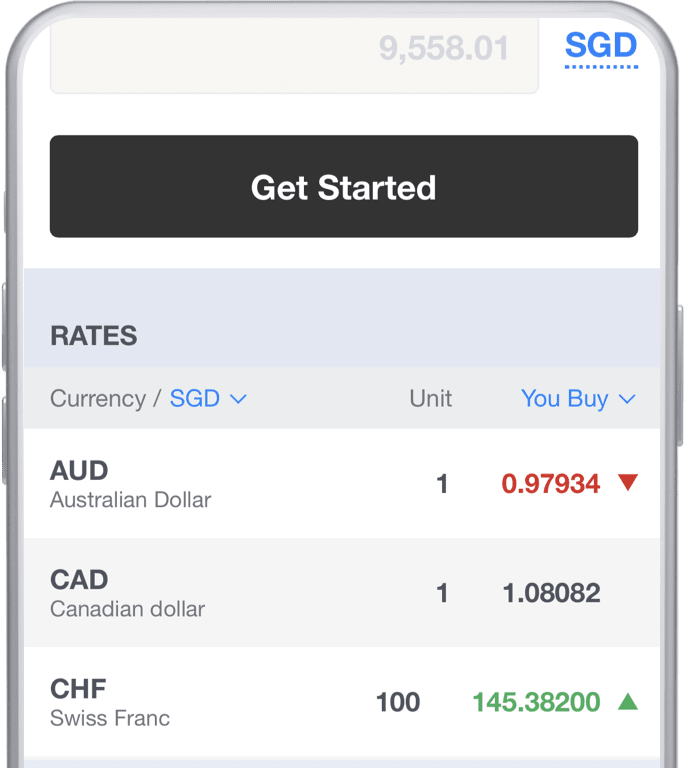

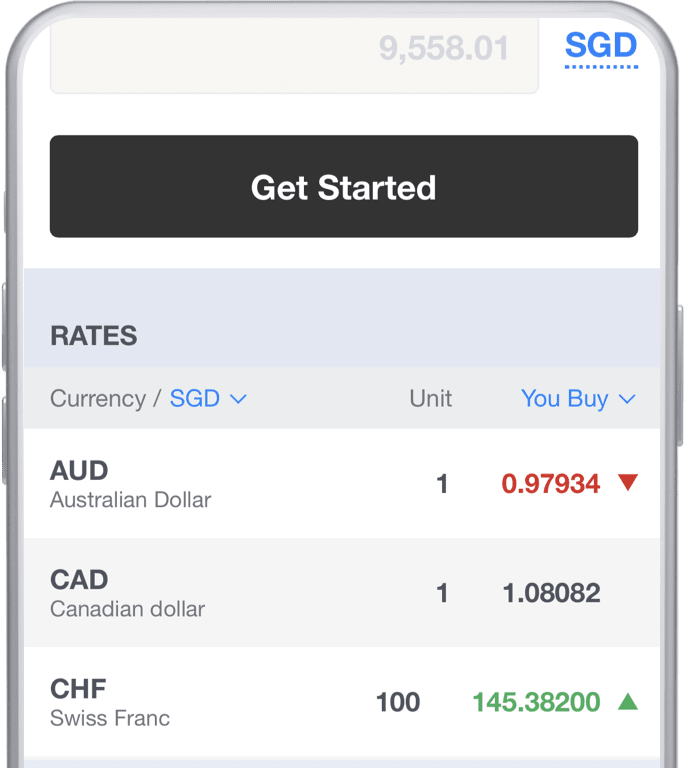

Use it to get real-time foreign exchange rates so you can book the rates that benefits your business most. Available 24 hours a day, Monday to Friday.

Enjoy the simplicity, speed and security to send or collect payments with the OCBC Business app. Stay tuned for more useful updates.

Stay in control by making and approving local and international transfers directly from your mobile.

Use this simple-to-use software to send invoices from your business account simply and swiftly.

Making online or contactless payments? Spend securely and save with cash rebates with the virtual debit card in the app.

How to create a Local Transfer (Local Telegraphic Transfer)

How to Create a GIRO Payroll

How to create a Local Transfer (GIRO)

How to create a Local Transfer (MEPS)

How to create a Local Transfer (FAST)

How to Create a Transaction Template (GIRO and FAST Payment)

How to Create an Internal Fund Transfer

Supercharge your business by unlocking the power of your business data. Get empowered, whether you are a one-person team or 200-strong, with multi-useful insights from your sales, expenses and cash flow trends and power on to even greater success.

You will also receive useful alert notifications on real-time transactions to help keep your business safe as well as set up multi-useful business alerts such as FX alerts to help you save more on foreign currency transactions and beyond.

Download the OCBC Business app now!

Get it on the Apple App Store

OCBC Business app is only available to business customers who have access to OCBC Velocity in Singapore.

If your company has yet to sign up for OCBC Velocity, please apply for OCBC Velocity here.

For local payments, you can make Internal Funds Transfers, Local Telegraphic Transfers, as well as MEPS, GIRO and FAST payments.

You can also make Overseas Telegraphic Transfers or IACH (Internaltional Automated Clearing House) transfers through the OCBC Business app.

Yes, you can make payments to your payees created in the app or OCBC Velocity.

To add payees:

Using OCBC Velocity

Using the OCBC Business app

You can approve cash and trade transactions - on the app and as well as on OCBC Velocity.

Your one-stop business transactions digital platform. Seamlessly manage your business accounts online and on the go.

No physical contact needed, no crowd. Open your business account online and get your account number on the spot. Simple, safe and convenient.

Fund your business expansion or enhance day-to-day operations.

Global Finance

2023 - 2024

Global Finance

2023 - 2024

The Asian Banker

2019 - 2023

The Asian Banker

2019 - 2023

Alpha Southeast Asia

2018 - 2023

Alpha Southeast Asia

2018 - 2023

Access to OCBC Velocity is free for all business accounts.

From your daily banking needs to complex control and approval structures, you can choose a setup that caters to your business' unique needs.

| Basic | Standard | Classic | Flex | |

|---|---|---|---|---|

|

Type of business each package is suitable for

|

Single-man operating businesses

|

Larger and more complex businesses

|

Larger and more complex businesses, where roles can be customised to reflect the appropriate access, controls and approval structures in your business

|

|

|

Number of person(s) that can operate OCBC Velocity

|

1 or more

|

At least 2 users

|

||

|

Roles available

|

Viewer

|

Viewer, maker and approver

|

Viewer, maker, approver and administrator

|

|

|

Functions of each role available

|

Viewer

Users can view account balances and statements only. No transactions can be performed. |

|||

|

|

Maker

Users who are appointed the role of a "maker" can perform transactions, including:

|

|||

Not registered for OCBC Velocity? Apply with this form.